Achieving financial independence is a life-changing goal that allows you to take control of your future. For many, the road to financial freedom may seem overwhelming, but with the right strategies, it becomes more attainable. One such strategy is the 50/30/20 rule, a simple yet effective way to manage your money without getting lost in complicated budgeting systems. This rule helps you balance your essential needs, discretionary spending, and savings, ensuring you meet your short-term obligations while planning for long-term financial security.

Let’s dive into how the 50/30/20 rule can be used to reach financial independence and improve your overall financial well-being.

What is Financial Independence?

Financial independence refers to the state of having enough personal wealth to live comfortably without the need for active employment. It’s about having enough investments, savings, and passive income streams to cover your living expenses indefinitely. When you reach financial independence, you no longer rely on a paycheck to maintain your lifestyle, granting you the freedom to pursue passions, retire early, or simply live stress-free.

People often pursue financial independence for various reasons: to escape the rat race, reduce financial anxiety, or focus on meaningful experiences rather than work-driven goals. However, achieving this milestone requires careful planning, disciplined savings, and wise investments.

The Importance of Budgeting

Budgeting is the foundation of financial success. It’s the process of creating a plan to manage your money so that you live within your means and allocate funds to essential areas of your life. Without a solid budget, it’s easy to overspend, accumulate debt, and miss out on opportunities to grow your savings.

The 50/30/20 rule is one of the easiest budgeting methods to follow because it provides a clear framework for allocating your income, ensuring you prioritize your needs, manage your wants, and save for the future. This rule can help reduce financial stress, prevent overspending, and improve your overall financial health, making it an excellent tool on your journey to financial independence.

Introducing the 50/30/20 Rule

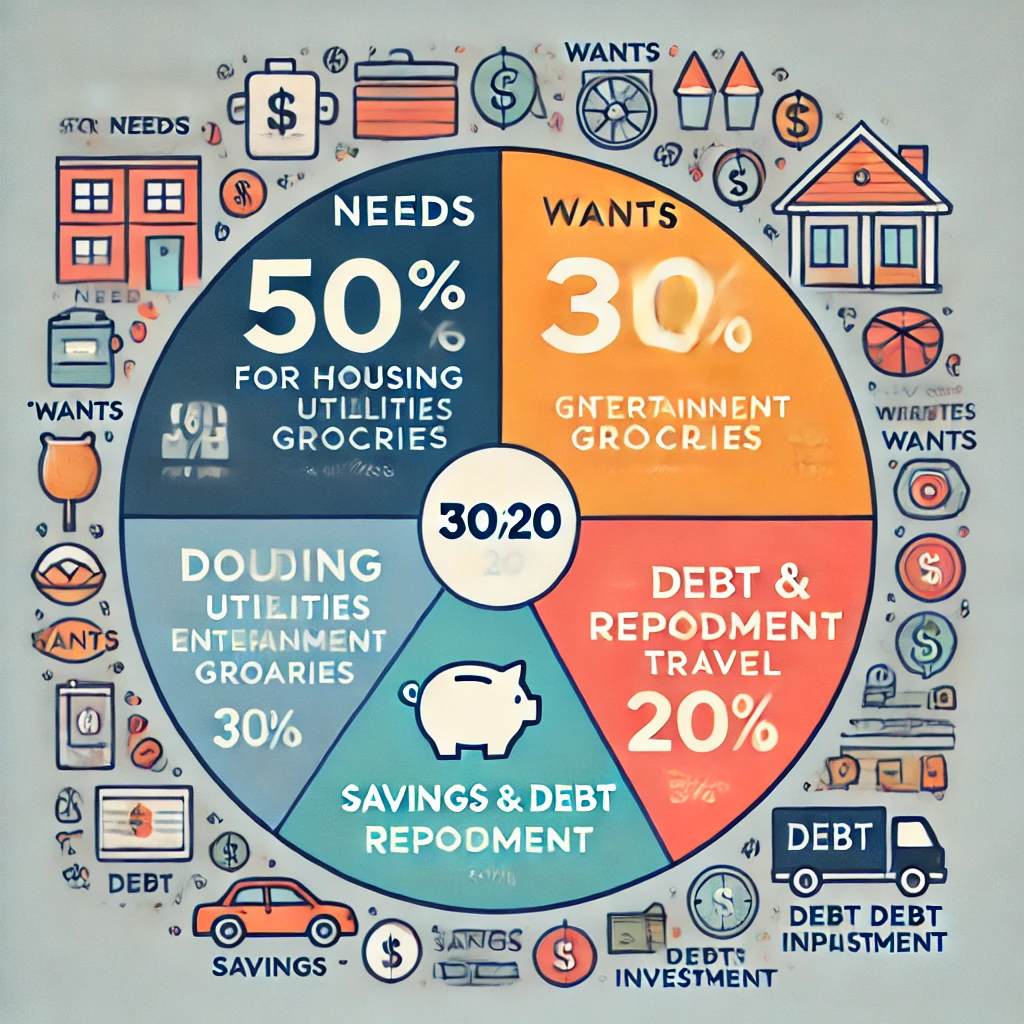

The 50/30/20 rule was popularized by Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan. It’s a straightforward approach to budgeting that divides your after-tax income into three categories:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayment

This rule simplifies financial management by setting limits on spending in key areas of your life. It’s adaptable to most income levels and life stages, making it a popular choice for those who want to build a sustainable financial plan without diving too deep into complex budgeting spreadsheets.

How the 50/30/20 Rule Works

Understanding how the 50/30/20 rule works is crucial to implementing it effectively. Here’s a closer look at how this breakdown applies to your finances:

- 50% Needs: These are your essential living expenses, such as housing, utilities, groceries, and transportation. Needs are the costs you must cover to maintain your basic standard of living.

- 30% Wants: This category covers discretionary spending on things like dining out, entertainment, travel, and hobbies. Wants are not essential, but they enhance your quality of life.

- 20% Savings and Debt Repayment: The remaining 20% of your income should go toward building an emergency fund, contributing to retirement savings, or paying off debt. This portion is key to achieving financial independence because it represents long-term wealth building.

By following this structure, you ensure that your financial obligations are met, your lifestyle desires are fulfilled in moderation, and your future is secured through savings and investments.

The 50%: Needs

When applying the 50/30/20 rule, your “needs” category represents half of your take-home pay. These are non-negotiable expenses that you can’t avoid. Prioritizing needs helps you maintain financial stability and ensure that your basic living standards are covered.

Housing and Utilities as a Need

Housing is often the largest expense in any budget. Whether you rent or own, mortgage or rent payments are part of the “needs” category. Utilities like electricity, water, and internet should also be factored in. Striking a balance between comfortable living and affordability is crucial here. Overextending your housing budget can limit your ability to allocate funds elsewhere, making it harder to save for the future.

Transportation Costs

Transportation, whether it’s public transit fares or vehicle-related expenses like fuel, insurance, and maintenance, falls under the “needs” category. However, there are ways to reduce transportation costs, such as opting for public transport, carpooling, or choosing a more fuel-efficient vehicle. Keeping transportation affordable ensures that you have more room in your budget for savings and wants.

Groceries and Essential Spending

Food is a necessity, but it’s easy to confuse essential groceries with luxury items. Budgeting for groceries should focus on nutritional needs rather than indulgences. Preparing meals at home rather than eating out can significantly reduce your food expenses, freeing up more of your budget for savings or discretionary spending.

The 30%: Wants

The wants category allows for flexibility and enjoyment in your budget. This portion covers anything that enhances your lifestyle but isn’t a necessity. However, staying within the 30% limit is essential to avoid overspending and ensure that you meet your savings goals.

Entertainment and Dining Out

Spending on entertainment and dining out can quickly add up if not managed properly. This includes things like movie tickets, concerts, restaurants, and bars. It’s important to enjoy life and relax, but not at the expense of financial independence. Allocating a portion of your budget to these activities helps you strike a balance between enjoying the present and saving for the future.

Travel and Vacation Planning

Vacations and travel are often categorized as wants. While travel can be enriching, it’s also important to budget for these experiences carefully. Planning ahead, booking during off-seasons, and saving specifically for trips ensures that you can enjoy them without derailing your long-term financial goals.

Subscriptions and Memberships

Recurring costs, such as gym memberships or streaming service subscriptions, are also part of the “wants” category. While these may seem like small expenses, they can add up quickly. Regularly reviewing and canceling subscriptions that you no longer use can help you stick to your 30% limit.

The 20%: Savings and Debt Repayment

Perhaps the most critical part of the 50/30/20 rule is the 20% allocated to savings and debt repayment. This category ensures that you are setting aside money for future needs and working toward financial independence.

Emergency Fund

An emergency fund is a critical component of any financial plan. It acts as a safety net for unexpected expenses, such as medical bills, car repairs, or sudden job loss. A good rule of thumb is to have three to six months’ worth of living expenses saved. By contributing to your emergency fund from the 20%, you protect yourself from financial emergencies that could derail your progress toward independence.

Debt Repayment Strategies

Reducing debt is a key step toward financial independence. Whether it’s credit card debt, student loans, or car payments, prioritizing debt repayment can help you lower interest costs and free up more of your income for savings and investments. Focusing on high-interest debt first (also known as the avalanche method) is a smart way to accelerate your debt-free journey.

You Can Also Read : How to Retire Early and Achieve Financial Independence

Retirement Savings and Investments

The final component of the 20% category is long-term savings and investments. Contributing to retirement accounts like a 401(k) or IRA is essential for building wealth over time. Additionally, investing in stocks, bonds, or real estate can help grow your wealth and provide passive income, making it easier to achieve financial independence sooner.